cayman islands tax residency certificate

Their role is to assist you in determining which solutions match your requirements to liaise with our partners and prepare and provide you with a. Cayman islands offers residence certificate or permanent residence to high net worth investors and their families who can invest 1 million or more in Cayman real estate according to immigration office.

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

Citizen andor resident in the US.

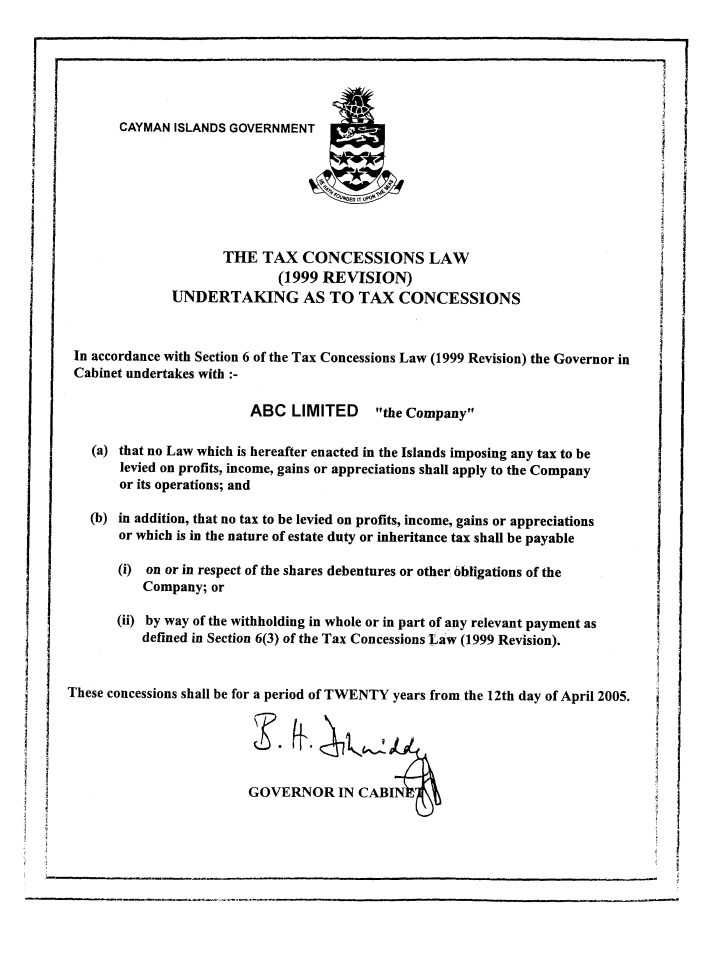

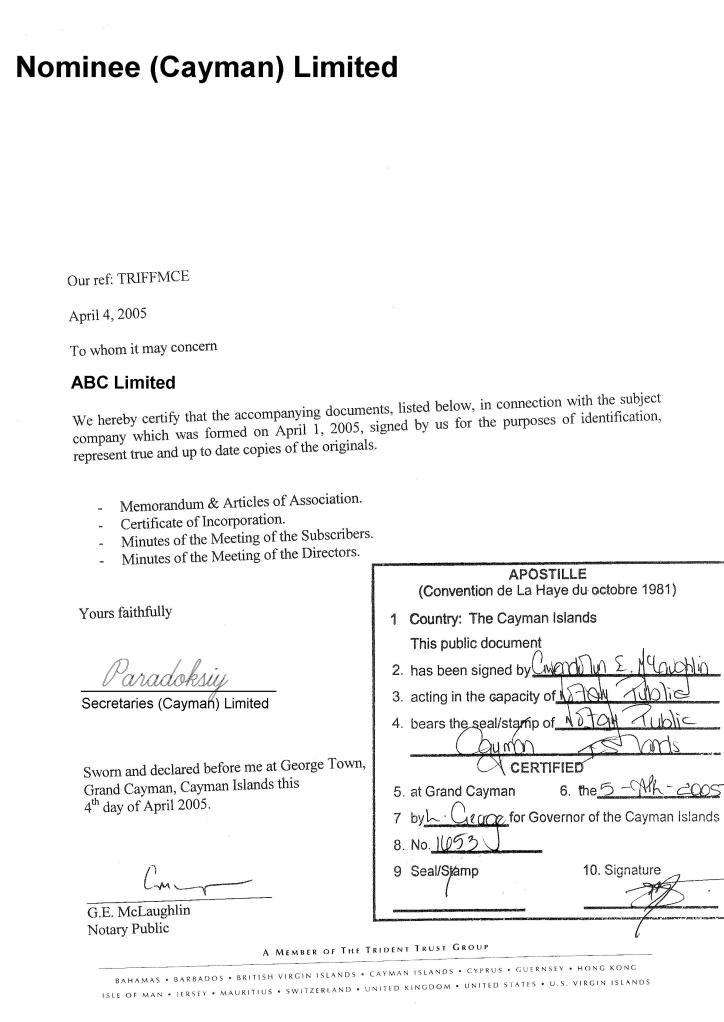

. To qualify applicants must invest CI500000 in real. Terms referenced in this Form shall have the same meaning as applicable under the relevant Cayman Islands Regulations Guidance Notes or international agreements. According to the Cayman ES Guidance v204 examples of satisfactory evidence include a tax identification number a tax residence certificate and an assessment or payment of corporate tax liability on all of the Cayman entitys income from a relevant activity in the Islands.

Applicants who meet the eligibility criteria and are of good character and health will be issued a Residency Certificate Substantial Business Presence valid for 25 years renewable entitling them to reside in the Cayman Islands and. Individual - Taxes on personal income. For tax purposes green card holder or resident under the substantial presence test and my US.

RESIDENCE FOR TAX PURPOSES Please tick either a or b or c and complete as appropriate. No income tax real estate taxes or capital gains tax. Application for the 5-year residencywork certificate.

The category is open to persons already resident in the Cayman Islands and persons wishing to become resident. This Certificate which is valid for 25 years and renewable thereafter entitles the holder and any qualifying dependants to reside in the Cayman Islands without the right to work. The offshore zone offers very interesting conditions for real estate customers applying for residency on that ground in order.

The fee to make an application for a Certificate of Direct Investment is CI1000 US121951 and if it is successful there is an issue fee of CI20000 US2439024. British territory under Queen Elizabeth ruling. As far as residency is concerned the Cayman Tax Information Authority has the liberty to grant tax residency certificates to all the individuals who are declared as residents of Cayman Islands.

Based on the current practice of the Hong Kong. Strong and safe legal system. Or as a person of independent means.

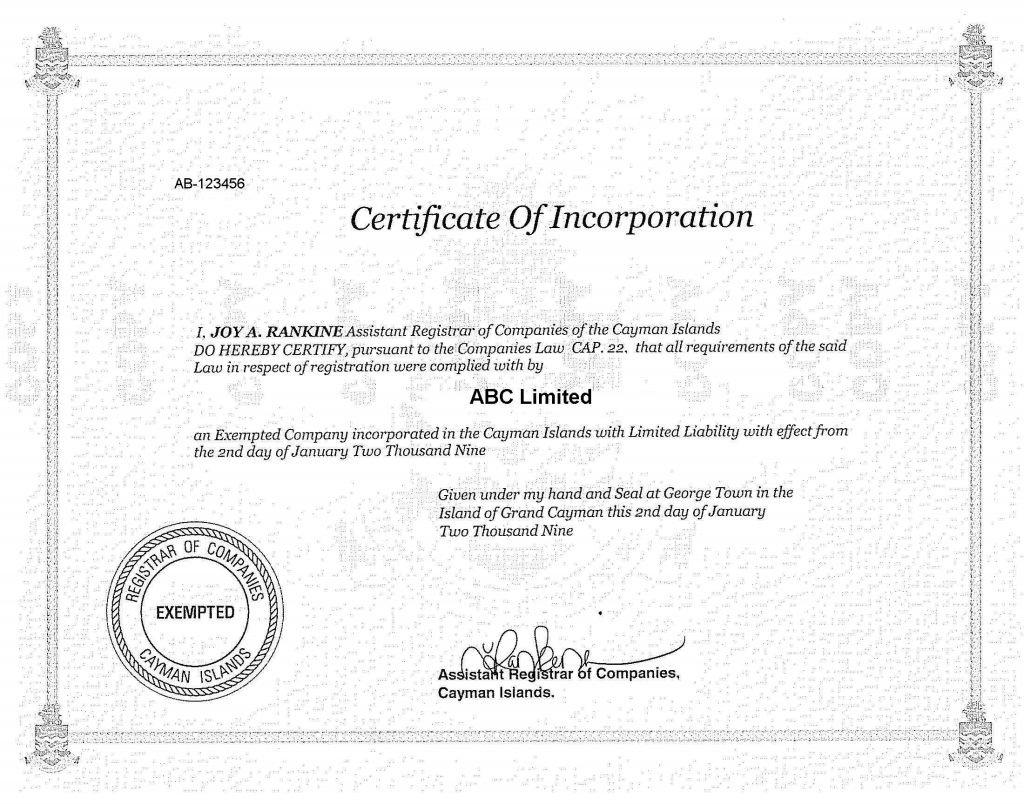

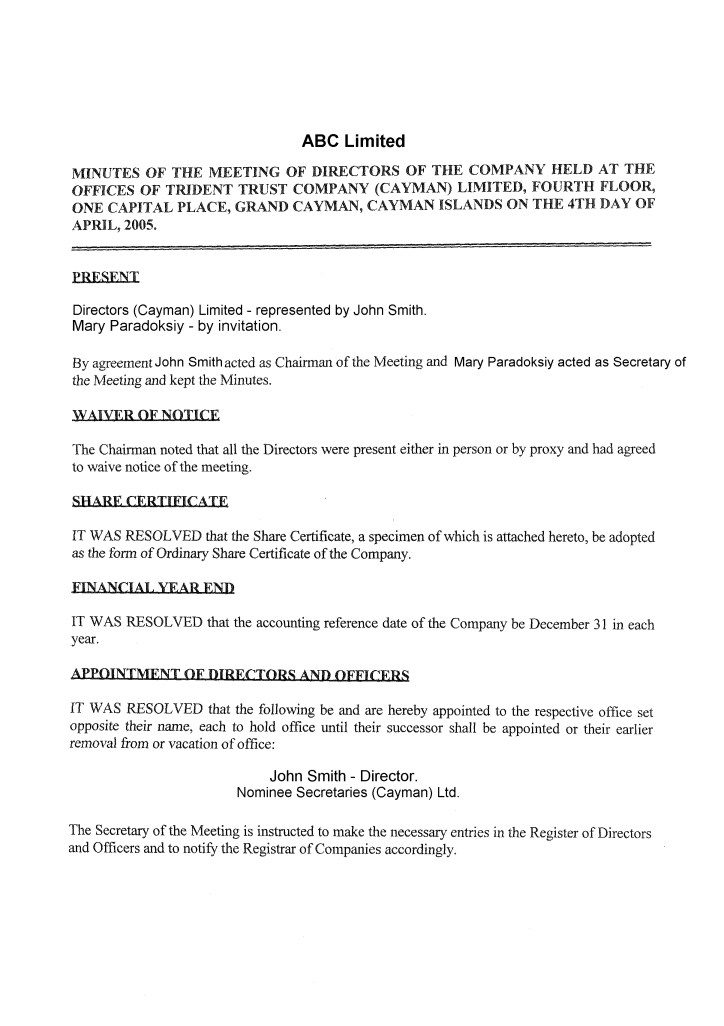

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in the Cayman Islands. Based on eight years of residence. Companies Register Partnerships Register Trusts Register Non-Profit Organisations Birth Death Marriages Civil.

In each case the business must have a substantial presence in the Cayman Islands. Any person who has been legally and ordinarily resident in the Cayman Islands for at least eight years but not more than nine years other than the holder of a. Cayman Islands- Tax Efficient Residency Visa.

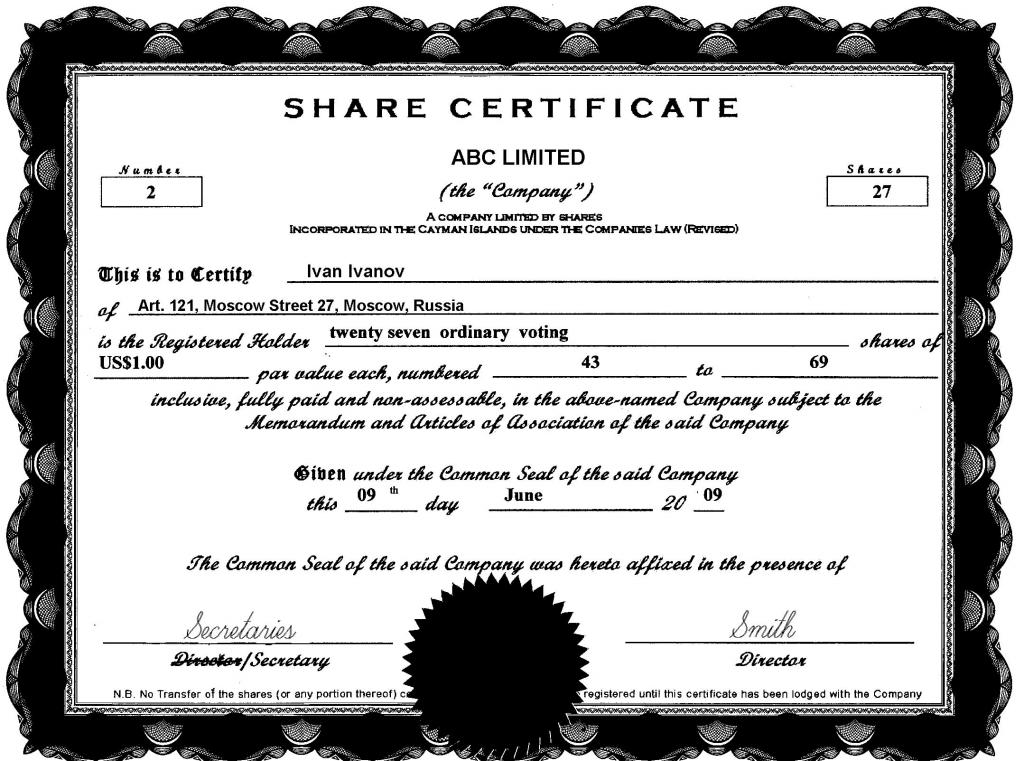

Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate residency is not relevant in the context of Cayman Islands taxation. Residency Certificate for Persons of Independent Means Valid for 25 years. A benefactor investing in the economy receives a resident certificate which gives him or her the opportunity to live permanently in the Cayman Islands.

There are no personal tax requirements in Cayman Islands. There are other ways to obtain residency on islands by acquiring residency certificates. Learn about real estate residency medical care taxes lifestyle cost of living and more.

The remaining CI500000 must be invested in a company or propertyand simply holding. Cayman Enterprise City CEC is a special economic zone in Grand Cayman. Residency Certificate for Persons of Independent Means.

In the case of individuals looking to reside in Grand Cayman an applicant is required to either. No property tax No income tax No company tax. Our mission is to deliver exceptional customer experience through the administration and regulation of entities and vital events registers.

Last reviewed - 08 December 2021. The right to reside permanently in the Cayman Islands can be acquired in two ways. The holder of a Certificate of Direct Investment must also be physically present in the Cayman Islands for a minimum of ninety days in aggregate in a calendar year.

To reside in Grand Cayman the person must show proof of an annual income of at least CI120000 without engaging in employment in the Cayman Islands along with an investment of CI1000000 of which CI500000 must be in developed real estate. Detailed information on how to retire in the Cayman Islands. 2 Certificate of Permanent Residence for Persons of Independent.

PCS will put you in contact with an adviser in your region. This may be relevant or desirable for citizens of European Union EU member states for the purposes of compliance with Reporting of Savings Income Information Law. Residency Certificate for.

There is no income tax no property tax and no corporate tax. 1 Residency Certificate for Persons of Independent Means. Demonstrate an annual income of at least 120000 or.

It is designed and intended to. If any of the information below regarding your tax residence or AEOI classification changes in the future please ensure you advise us of these changes promptly. There are also no withholding taxes imposed on consumption in Cayman Islands either.

There are currently four residency options available to those with the means to make a significant investment in the Cayman Islands. We Are Here To Help You. Entities engaged in scheduled trade and business in the Cayman Islands as defined in the Trade.

The spouse and any dependent children of a holder of a Residency Certificate for Persons of Independent Means that were listed in the application and who were approved by the Chief Immigration Officer will be granted a Residency Holders Dependants Certificate entitling them to reside in the Cayman Islands without the right to work. It includes a state-of-the-art campus consisting of five business parks welcoming international companies from key sectors such as Internet Technology Media Marketing Commodities Derivatives Academia Training and Biotech. A Residency Certificate Substantial Business Presence is available to individuals who either own at least a 10 share in an approved category of business or will be employed in a senior management capacity within such a business.

Maintain a deposit of at least 400000 in a licensed financial institution in the Cayman Islands and make an investment of at least 1 million including 500000 in developed real estate in. An applicant must invest a minimum of CI1000000 US1219513 of which at least CI500000. A I confirm that I am a US.

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Fillable Online Person Married To A Caymanian Cayman Islands Immigration Bb Fax Email Print Pdffiller

How To Get Cayman Islands Residency 7th Heaven Properties

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

How To Get Cayman Islands Residency And Pay Zero Tax

The Cayman Islands Residency By Investment Programme Latitude

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Registration And Tax Questionnaire Guidance Alphabet Google Suppliers Help

How To Get Cayman Islands Residency And Pay Zero Tax

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

Entity Self Certification Form Cayman Islands Department Of

Cayman Islands Residency By Investment Tax Efficient Residency

Rerc Cayman Fill Online Printable Fillable Blank Pdffiller

Resources For Global Investment And Immigration Uglobal

The Cayman Islands Residency By Investment Programme Latitude

How To Get Cayman Islands Residency And Pay Zero Tax

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl

How To Get Cayman Islands Residency And Pay Zero Tax

Company Registration In Cayman Islands Business Starting Setup Offshore Zones Gsl